Group Chief Executive Officer’s report

Our new purpose of enabling a more resilient future has been a great foundation for QBE in another particularly dynamic year for the insurance industry. Our vision to become the most consistent and innovative risk partner provides clear guardrails as we seek to build deep and lasting relationships with our customers.

Foster an orderly and inclusive transition to a net‑zero economy |

We support an orderly and inclusive transition to a net-zero emissions economy. We recognise the importance of addressing climate change and incorporating climate-related risks and opportunities into our decision making, facilitating a resilient future for our business, customers and people. QBE has made net-zero commitments in relation to our own operations, investments, and underwriting. In line with our NZAOA net zero 2050 investment portfolio commitments, we are progressing on our interim targets for 2025.

Since joining the NZIA in 2022, we are laying the foundations to set interim targets for our underwriting portfolio. QBE has contributed to the development of insurance-associated emissions through the Partnership for Carbon Accounting Financials (PCAF) and NZIA. In January 2023, the NZIA issued the first Target-Setting Protocol for the global insurance sector. The Protocol will guide the form of QBE’s interim targets for 2030.

Our supply chain can also be a significant source of emissions and we have committed to commencing formal engagement on net-zero progress with large suppliers in our global supply chain, with the goal of setting targets for those large suppliers by 2025. We have initiated contact with a sub-set of suppliers, with engagement scheduled to commence in early 2023.

We are working to support an orderly and inclusive transition to a net-zero economy, aligned with UN objectives of limiting warming to 1.5 degrees by the end of 2100. We will take actions within our control, engage for impact and advocate to influence progress on the decarbonisation of the real economy. We are setting interim targets and engaging with our customers and other partners to foster an orderly transition.

Our ambition includes consideration of the social implications of climate risk and transition. Through our QBE Foundation partners, we continue to support initiatives that increase the resilience to, and mitigation of, the impacts of a changing climate. We focus on helping communities experiencing vulnerability to adapt and expand their food and water security, especially those at risk of displacement. We will continue to strive to meet our existing sustainability commitments through our underwriting, investments, own operations, and how we engage with our supply chain. This includes turning our focus to sustainable claims management practices.

Enable a sustainable and resilient workforce |

The culture and capability of our people are drivers of value for QBE. A sustainable and resilient workforce is underpinned by how we engage and connect our people to our purpose and vision. Investing in our people’s career development, and supporting flexibility and wellbeing can allow us to continue to attract and retain the best talent.

Our people strategy is focused on driving culture through performance and reward, growing leadership capability and improved internal succession. We continue to prioritise investing in our people and strategic workforce planning for the future.

Our strategy enables us to support our workforce and our customers and communities to adapt in response to economic, environmental and social changes, such as climate adaptation and emissions reduction.

We recognise the value of developing our people. We will seek to integrate sustainability and drive engagement by harnessing the energy and enthusiasm of our people. Everyone will have a role to play.

By 2025, we seek to increase our enterprise-wide understanding of sustainability to better deliver on our strategic priorities. We are strengthening a sustainability connection to our purpose, vision and DNA, and ensuring our people understand the role they play and have opportunities to engage and meaningfully contribute.

Sustainability metrics are embedded into our executives’ variable remuneration and will evolve over time to reflect our sustainability ambitions. In addition, we will expand our Inclusion of Diversity targets beyond gender to focus on ethnicity, disability, and LGBTIQ+ to continue to foster a culture of belonging.

Across the enterprise, we will continue to strengthen and build our workplace culture, and embed sustainability into strategic decision making, linked to our purpose of enabling a resilient future.

Partner for growth through innovative, sustainable and impactful solutions |

Our landscape is changing, presenting opportunities to partner with our customers and others for growth through innovation. There are opportunities beyond insurance products to partner on impactful solutions through our investments, supplier and broker relationships, the QBE Foundation and QBE Ventures. We can explore ways to co-create solutions to meet the changing needs of our customers, and support communities affected by climate impacts, the net-zero transition and rising inequality.

Our ambition by 2025 is to have explored new partnership opportunities across the many stakeholders with which we can work, to grow through innovative, sustainable and impactful solutions. We will seek to amplify any successful solutions in one division across our global enterprise to improve outcomes for customers, communities, society, the environment and the economy.

We continue to support programs that respond to catastrophes, often caused by severe weather events, and in October 2022, we renewed our three-year partnership with the Red Cross and Save the Children. We will also continue to collaborate with industry, government and civil society to support the achievement of our priority UN Sustainable Development Goals.

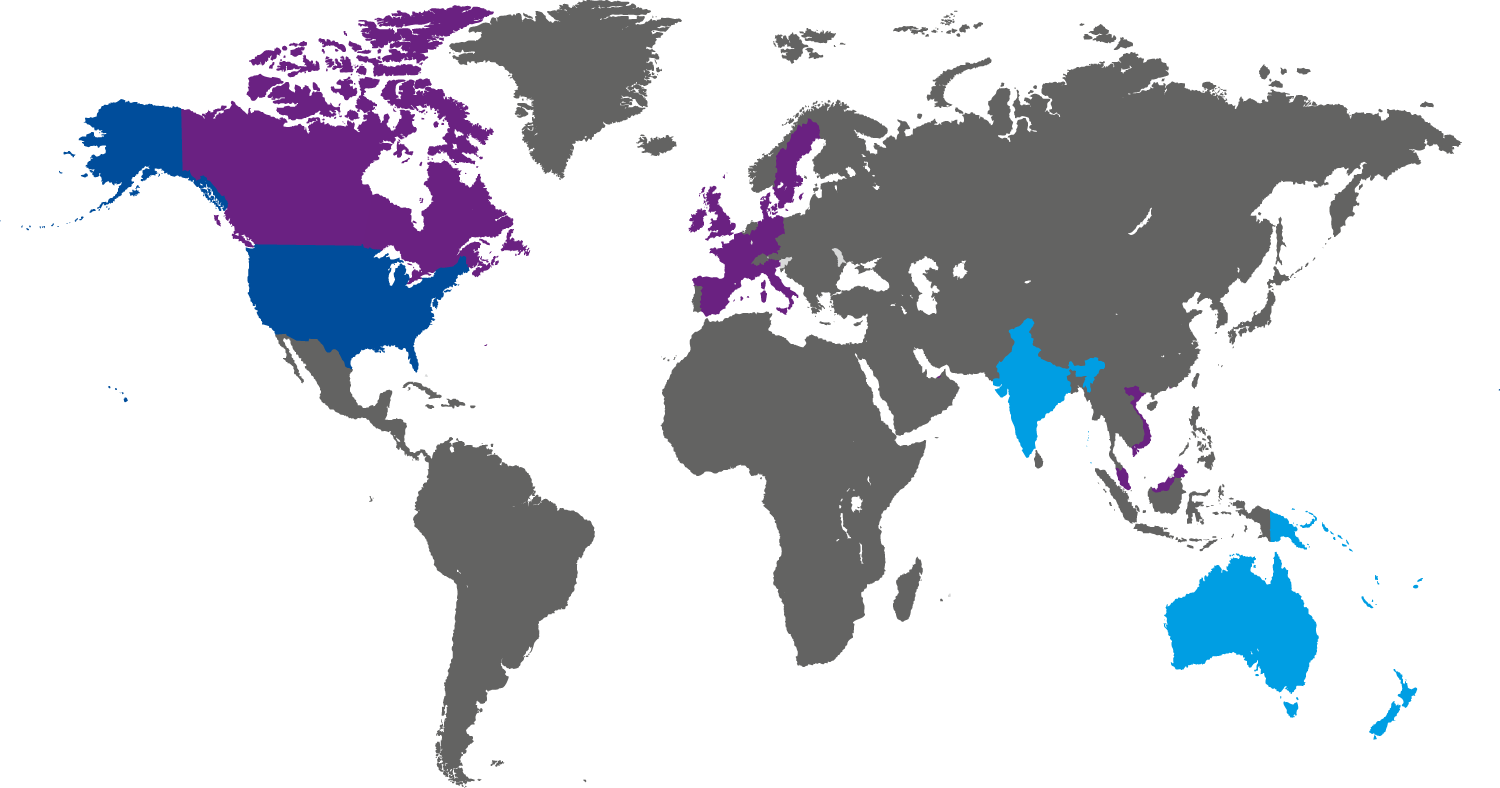

The favourable premium rate environment alongside expanding benefits associated with portfolio optimisation initiatives, exposure management, and the pursuit of targeted organic growth have supported a return to underwriting profit for North America.

In a year characterised by numerous external challenges, the benefits from International’s ongoing focus on resiliency, portfolio optimisation and targeted growth were clear in a combined operating ratio of 92.5%.

Australia Pacific recorded an improvement in combined operating ratio to 90.1%, sustaining positive rating momentum and targeted volume growth, alongside foundational investment to support medium-term modernisation initiatives.

Integrating sustainability into our business can help us deliver on our purpose of enabling a more resilient future. We believe that addressing current and emerging sustainability risks and opportunities allows us to be a consistent and innovative risk partner, responding to the needs of our customers, people, and the communities in which they live.

At QBE, we're driven by our purpose of enabling a more resilient future. Integrating sustainability in our business will help us to achieve that future.

Major sustainability challenges, including climate change, human rights abuses, and biodiversity loss, can weaken resilience because they create new risks, or magnify existing ones, with potentially devastating consequences.

Integrating sustainability into how we do business means we are shifting the concept of “business as usual” to include consideration of material non-financial issues that reduce risk, and support our people, customers, society, and the environment.

We believe that progressing our sustainability commitments can enable QBE to attract and retain talent, customers, and capital, into the future. These factors are essential to maintaining QBE’s financial stability and, by extension, the stability of the insurance sector and the economies in which we live and work.

As an international insurer and reinsurer, we see first‑hand the impacts of a changing climate on our customers, communities and partners. This is why we support an orderly and inclusive transition to a net‑zero emissions economy.

QBE’s ability to meet our net-zero commitments is related to the actions we take in relation to our own operations, our investments and our underwriting portfolios. Our success is reliant on many factors, including the development of new technology associated with carbon removal and emissions reduction. It also depends on the progress individuals, businesses and economies can make to transition to net zero collectively, particularly in developed countries with net-zero commitments. We seek to understand the climate science and the economic and social factors at play and QBE considers three spheres of influence in delivering on our commitments and driving change in the real economy.

Find out more here

Wherever we operate, we are committed to understanding and managing the direct, and indirect, environmental impacts of our operations to try to minimise them. In 2022, we continued to deliver on our internal net-zero roadmap and this year, 100% of our electricity use across QBE offices (excluding the Pacific Islands and Bermuda) was certified as renewable.

We continue to be recognised for our focus on environmental sustainability. In 2022, we were recognised as the inaugural winner of the Excellence in Environmental, Social and Governance Change at the 2022 Australian Insurance Industry Awards. Additionally, we were awarded Green Insurer of the Year for the third year running by comparison site Finder.

Reduce energy use by 25% by 2025 (from 2019 levels)

STATUS: On track

OUR PROGRESS: Reduced by 20%

Use 100% renewable electricity for our operations by 2025

STATUS: Achieved

OUR PROGRESS: Maintained RE100

Reduce Scope 1 and 2 carbon emissions by 30% by 2025 (1.5 trajectory aligned science-based target, from 2018 levels)

STATUS: Achieved

OUR PROGRESS: Reduced by 75%

Reach net zero emissions for our operations by 2030

STATUS: On track

OUR PROGRESS: Reduced by 45% from 2019 levels

Maintain carbon neutrality 1 on defined inventory related to our global operations

STATUS: Achieved

1 On defined emissions inventory related to our operations, see our data book.

Premiums4Good is our innovative impact investing initiative that sees us invest everyday premiums to make a difference to communities across the globe.

As a responsible institutional investor, we invest for impact while seeking an attractive risk-adjusted return. Premiums4Good supports our belief that we can deliver attractive risk-adjusted returns and business value, while delivering a positive social and/or environmental impact.

The QBE Foundation seeks to create strong, resilient and inclusive communities. We work in partnership with community organisations, with a focus on climate resilience and inclusion – two areas where we believe we can have the greatest impact.

In 2023, we will reset our sustainability scorecard to align to our three focus areas and to consider the short to medium-term time horizon on our material targets.